Yes! You can use AI to fill out Form 4562, Depreciation and Amortization

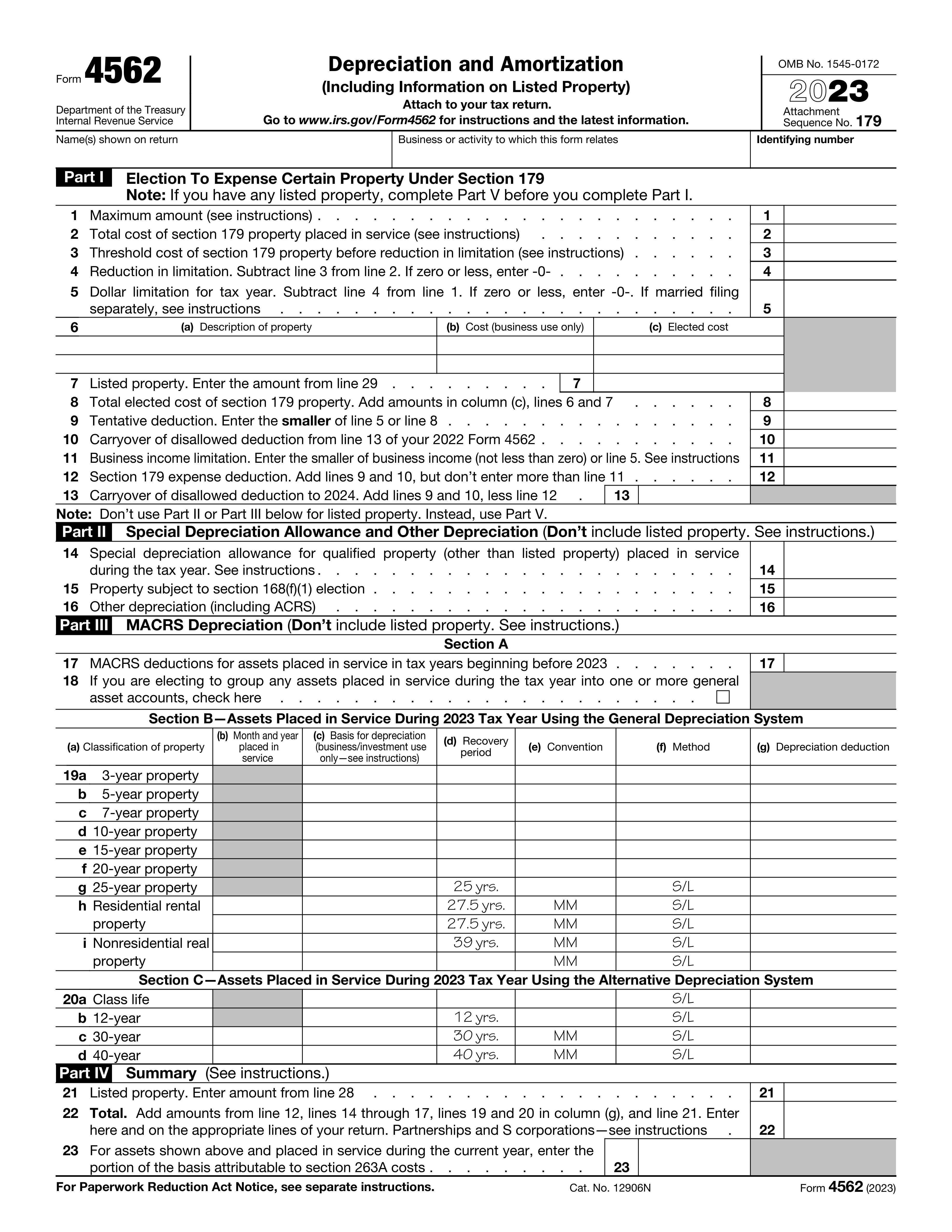

Form 4562, officially known as the Depreciation and Amortization form, is used by individuals and businesses to report depreciation and amortization deductions for property used in their business or for income production. It's crucial for accurately calculating and claiming these deductions on tax returns, ensuring compliance with IRS regulations.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 4562 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 4562, Depreciation and Amortization |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 261 |

| Number of pages: | 2 |

| Version: | 2023 |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 4562 Online for Free in 2026

Are you looking to fill out a FORM 4562 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 4562 form in just 37 seconds or less.

Follow these steps to fill out your FORM 4562 form online using Instafill.ai:

- 1 Visit instafill.ai and select Form 4562.

- 2 Enter business or activity details.

- 3 Fill in property depreciation information.

- 4 Complete listed property details if applicable.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 4562 Form?

Speed

Complete your Form 4562 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 4562 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 4562

Form 4562 is used by businesses to report depreciation and amortization. This includes the deduction for depreciation of property placed in service during the tax year, the deduction for amortization of costs that began during the tax year, and the deduction for any vehicle reported on a form other than Schedule C (Form 1040 or 1040-SR). It is also used to claim the Section 179 expense deduction and any special depreciation allowance.

The maximum amount you can expense under Section 179 is determined by the IRS and is subject to change each tax year. For the most recent tax year, you should refer to the IRS guidelines or the instructions for Form 4562. This amount is also subject to a phase-out threshold, which reduces the maximum deduction dollar for dollar once the total cost of Section 179 property placed in service during the tax year exceeds a certain limit.

Listed property includes certain types of property that can be used for both business and personal purposes, such as passenger automobiles, computers, and cellular phones. The use of listed property affects your Form 4562 because if the business use of the property is 50% or less, you must use the Alternative Depreciation System (ADS) to depreciate the property. Additionally, you may need to provide detailed information about the use of the property on Form 4562.

Yes, you can claim a special depreciation allowance on Form 4562 for qualified property. This allowance, often referred to as bonus depreciation, allows you to deduct a significant percentage of the cost of the property in the year it is placed in service. The percentage and eligibility criteria for the special depreciation allowance can vary by tax year and specific circumstances, so it's important to refer to the latest IRS guidelines or the instructions for Form 4562.

The business income limitation for the Section 179 expense deduction is calculated by determining your taxable income from the active conduct of any trade or business during the year. You cannot deduct more than your taxable income from all your trades or businesses combined. If the total cost of your Section 179 property placed in service during the year is more than your taxable income, the excess amount can be carried over to the next tax year, subject to the same limitation.

The Modified Accelerated Cost Recovery System (MACRS) and the Accelerated Cost Recovery System (ACRS) are both methods used for calculating depreciation for tax purposes. ACRS was introduced by the Economic Recovery Tax Act of 1981 and applied to property placed in service between 1981 and 1986. MACRS, which replaced ACRS, applies to property placed in service after 1986. The main difference lies in the depreciation periods and methods: MACRS generally allows for a longer recovery period and offers more flexibility in depreciation methods, including the option to use straight-line depreciation over the MACRS recovery period.

To report depreciation for assets placed in service in previous years on Form 4562, you must continue to use the same depreciation method and recovery period that you started with when the asset was first placed in service. You should report the depreciation for the current year in the appropriate section of the form, ensuring that you account for any adjustments or changes in use that might affect the depreciation calculation.

For vehicles used for business purposes, Form 4562 requires detailed information including the vehicle's cost or other basis, the date it was placed in service, the depreciation method and convention used, and the amount of depreciation claimed for the current year. Additionally, if the vehicle is considered listed property, you must provide information on the percentage of business use versus personal use.

Part V of Form 4562 is used to report information on listed property, which includes certain types of property that can be used for both business and personal purposes, such as vehicles. To complete Part V, you must provide details on the property's cost, the date it was placed in service, the business-use percentage, and the depreciation method and amount. If the business use of the property is 50% or less, you must use the straight-line method over the ADS recovery period.

To claim depreciation on vehicles provided to employees, the vehicle must be used for business purposes, and the business use must be substantiated. The employer must keep detailed records of the vehicle's use, including the total miles driven and the miles driven for business purposes. The depreciation can be claimed on Form 4562, and the amount of depreciation will depend on the vehicle's cost, the percentage of business use, and the applicable depreciation method and recovery period.

To calculate the total depreciation and amortization to report on your tax return, you need to sum up the depreciation and amortization amounts for all assets used in your business or for the production of income. This includes assets placed in service during the tax year and those from previous years. Use the appropriate depreciation method and recovery period for each asset as prescribed by the IRS. The total amount is then reported on Form 4562, which is attached to your tax return.

The business/investment use percentage for listed property is significant because it determines the portion of the property's cost that can be depreciated or expensed under Section 179. Listed property includes items like vehicles, computers, and cellular phones that are used for both business and personal purposes. The percentage reflects the extent to which the property is used for business or investment purposes, and only that portion of the cost is eligible for depreciation or Section 179 deduction.

If your Section 179 deduction is disallowed in a tax year because it exceeds your business income, you can carry over the disallowed amount to the next tax year. The carryover amount is added to the Section 179 deduction for the next year, subject to the same limitations. You must keep track of the carryover amount and report it on Form 4562 for the year in which you claim the deduction.

For vehicles used by more than 5% owners, you must complete Section B of Form 4562 to report the vehicle's cost, the business/investment use percentage, and the depreciation deduction. This section requires detailed information about the vehicle's use, including the total miles driven during the year and the miles driven for business purposes. The depreciation deduction is calculated based on the business use percentage and the applicable depreciation method.

You may meet an exception to completing Section B for vehicles used by employees if the vehicle is used exclusively for business and is not available for personal use, or if the vehicle is part of a qualified automobile demonstration program. Additionally, if the vehicle is used by an employee who is not a more than 5% owner and the use is properly substantiated under an accountable plan, you may not need to complete Section B. Review the specific IRS guidelines and exceptions to determine if you qualify.

To amortize costs on Form 4562, you must first identify the intangible assets that qualify for amortization. These assets typically include patents, copyrights, and certain types of software. Once identified, you will need to determine the amortization period, which is usually the asset's useful life. The costs are then amortized over this period using the straight-line method, unless another method is specified by the IRS. You must report the amortization on Part VI of Form 4562, providing details such as the description of the intangible property, the date the amortization began, and the amortization amount for the year.

If the amortization of costs began before the current tax year, you should continue to report the amortization on Form 4562 in the current year. You will need to provide the same details as for new amortization, including the description of the intangible property, the date the amortization began, and the amortization amount for the year. It's important to ensure that the total amortization period does not exceed the asset's useful life as initially determined.

For reporting residential rental property depreciation on Form 4562, you must first determine the property's basis, which is typically its cost plus any improvements minus any land value. Residential rental property is depreciated over 27.5 years using the straight-line method. You will report this depreciation in Part III of Form 4562, where you'll need to provide details such as the property's description, the date it was placed in service, and the depreciation method and convention used. Additionally, you must report the depreciation amount for the current year.

Grouping assets into general asset accounts for depreciation purposes involves combining similar assets into a single account to simplify the depreciation process. This is typically done for assets that are similar in nature and have the same depreciation method, recovery period, and convention. To group assets, you must first identify the assets that qualify for grouping. Then, you can report the group as a single asset in Part III of Form 4562, providing a general description of the group, the date the group was placed in service, and the depreciation method and convention used. The depreciation for the group is then calculated and reported as a single amount.

Using the standard mileage rate for vehicle expenses on Form 4562 has several implications. First, it simplifies the calculation of vehicle expenses by allowing you to multiply the total miles driven for business purposes by the standard mileage rate set by the IRS. However, choosing the standard mileage rate means you cannot deduct actual expenses such as gas, repairs, and depreciation. If you opt for the standard mileage rate, you must report it in Part V of Form 4562, where you'll provide details such as the vehicle's description, the total miles driven, and the business miles percentage. It's important to note that once you choose the standard mileage rate for a vehicle, you must continue to use it for the life of the vehicle, unless the IRS allows a change.

Compliance Form 4562

Validation Checks by Instafill.ai

1

Ensures that the name(s) entered matches exactly with the name(s) on the tax return.

The AI software ensures that the name(s) entered on Form 4562 exactly matches the name(s) listed on the tax return. This is crucial for maintaining consistency across tax documents and avoiding discrepancies that could lead to processing delays. It cross-references the names with those on file to confirm accuracy. This step is vital for ensuring that the form is correctly associated with the taxpayer's records.

2

Confirms that the business or activity name and identifying number are accurately provided.

The AI software confirms that the business or activity name and identifying number are accurately provided on Form 4562. It checks for the presence of this information and verifies its accuracy against existing records. This ensures that the form is correctly attributed to the appropriate business entity or activity. Accurate identification is essential for the proper processing and tracking of the form.

3

Verifies that Part V is completed before Part I if listed property is involved.

The AI software verifies that Part V of Form 4562 is completed before Part I if listed property is involved. This ensures that the form is filled out in the correct sequence, which is necessary for accurately reporting depreciation and amortization. It checks for the presence of listed property and ensures that the corresponding sections are completed in the proper order. This validation helps prevent errors that could affect the calculation of depreciation and amortization expenses.

4

Checks that the maximum amount for the election to expense certain property under Section 179 is correctly entered.

The AI software checks that the maximum amount for the election to expense certain property under Section 179 is correctly entered on Form 4562. It validates the amount against the current year's limits and ensures that it does not exceed the allowable maximum. This step is crucial for accurately calculating the taxpayer's deduction and avoiding potential issues with the IRS. It also ensures compliance with tax laws regarding the expensing of property.

5

Validates the calculation of the reduction in limitation by subtracting the threshold cost from the total cost.

The AI software validates the calculation of the reduction in limitation by subtracting the threshold cost from the total cost on Form 4562. It ensures that this calculation is performed accurately to determine the correct limitation amount. This validation is important for accurately reporting the taxpayer's depreciation and amortization expenses. It helps prevent errors that could lead to incorrect tax liabilities or refunds.

6

Ensures the dollar limitation for the tax year is accurately calculated by subtracting the reduction in limitation from the maximum amount.

The AI software ensures that the dollar limitation for the tax year is accurately calculated by subtracting the reduction in limitation from the maximum amount. This calculation is crucial for determining the correct depreciation and amortization deductions. It verifies that the subtraction is performed correctly to avoid any discrepancies in the tax filing. This step is essential for compliance with tax regulations and for maximizing the allowable deductions.

7

Confirms that the property description, cost (business use only), and elected cost are correctly entered in lines 6(a) through 6(c).

The AI software confirms that the property description, cost (business use only), and elected cost are correctly entered in lines 6(a) through 6(c). It checks for accuracy in the description to ensure that the property is correctly identified. The software also verifies that the costs are accurately reported and that the business use percentage is correctly applied. This validation is critical for ensuring that the depreciation calculations are based on accurate and complete information.

8

Verifies that the amount from line 29 for listed property is correctly entered in line 7, if applicable.

The AI software verifies that the amount from line 29 for listed property is correctly entered in line 7, if applicable. It ensures that the transfer of this amount is accurate and that it is only included when relevant. This step is important for maintaining the integrity of the depreciation and amortization calculations. It also helps in ensuring that the form complies with the specific requirements for listed property.

9

Checks the total elected cost of Section 179 property is accurately calculated by adding the amounts in column (c) of lines 6 and 7.

The AI software checks that the total elected cost of Section 179 property is accurately calculated by adding the amounts in column (c) of lines 6 and 7. It ensures that the addition is performed correctly to reflect the total cost eligible for the Section 179 deduction. This validation is crucial for accurately determining the allowable deduction under Section 179. It also helps in ensuring that the taxpayer is taking full advantage of the tax benefits available for qualifying property.

10

Ensures the tentative deduction is correctly determined by entering the smaller of line 5 or line 8.

The AI software ensures that the tentative deduction is correctly determined by entering the smaller of line 5 or line 8. It verifies that the comparison between these two lines is accurately made to determine the correct deduction amount. This step is essential for calculating the maximum allowable deduction without exceeding the limits. It also plays a critical role in ensuring that the taxpayer's deductions are optimized while remaining within the legal boundaries.

11

Validates the inclusion of any carryover of disallowed deduction from the 2022 Form 4562.

Ensures that any carryover of disallowed deduction from the previous year's Form 4562 is accurately included in the current form. This validation confirms that taxpayers do not overlook the necessity of reporting carryover amounts, which could affect their current year's tax liabilities. It checks for the presence of these amounts in the designated sections of the form, ensuring compliance with IRS regulations. Additionally, it verifies that the carryover amounts are correctly calculated and reported, preventing potential discrepancies in tax filings.

12

Confirms the accurate calculation of the business income limitation and the Section 179 expense deduction.

Verifies that the business income limitation and Section 179 expense deduction are accurately calculated according to IRS guidelines. This check ensures that taxpayers correctly apply the limitations and deductions, which are crucial for determining the allowable expense amounts. It scrutinizes the calculations to prevent overstatement or understatement of deductions, which could lead to audits or penalties. Furthermore, it confirms that the calculations align with the taxpayer's business income, ensuring that the deductions are within the permissible limits.

13

Checks for the correct notation of any carryover of disallowed deduction to 2024.

Ensures that any disallowed deductions that are to be carried over to the next tax year are correctly noted on the form. This validation is crucial for maintaining accurate tax records and ensuring that taxpayers can claim these deductions in the future. It checks that the carryover amounts are clearly indicated and properly documented, facilitating their recognition in subsequent tax filings. Additionally, it verifies that the notation aligns with IRS requirements, preventing any issues with future tax claims.

14

Ensures that Parts II and III correctly exclude listed property and accurately enter information on special depreciation allowance, other depreciation, and MACRS depreciation.

Confirms that Parts II and III of Form 4562 accurately exclude listed property and correctly enter information regarding special depreciation allowance, other depreciation, and MACRS depreciation. This validation ensures that taxpayers correctly categorize and report their depreciation expenses, which is essential for accurate tax reporting. It checks that the information entered aligns with IRS definitions and guidelines, preventing misclassification of assets. Furthermore, it verifies that the depreciation methods and amounts are correctly applied, ensuring compliance with tax laws and regulations.

15

Verifies that Part IV accurately summarizes the amounts from previous parts and correctly enters the total on the appropriate lines of the tax return.

Ensures that Part IV of Form 4562 accurately summarizes the amounts reported in the previous parts and correctly enters the total on the appropriate lines of the tax return. This validation is critical for ensuring that the total depreciation and amortization expenses are correctly reported to the IRS. It checks that the summary accurately reflects the detailed information provided in earlier sections, preventing discrepancies in the tax return. Additionally, it verifies that the totals are correctly transferred to the tax return, ensuring that the taxpayer's filings are accurate and compliant with IRS requirements.

Common Mistakes in Completing Form 4562

A frequent error involves miscalculating the Section 179 expense deduction, which can lead to either understating or overstating the deduction. This mistake often occurs due to misunderstanding the eligibility criteria or the calculation method. To avoid this, taxpayers should thoroughly review the IRS guidelines on Section 179 deductions, ensuring they understand the types of property that qualify and the calculation process. Consulting with a tax professional can also help ensure accurate calculations and compliance with tax laws.

Taxpayers sometimes fail to complete Part V for listed property before moving on to Part I, which can result in inaccuracies in the depreciation and amortization deductions. This mistake can be avoided by carefully following the form's instructions, which specify the order in which parts should be completed. Ensuring that all relevant information about listed property is accurately reported in Part V before proceeding to Part I is crucial for the correct calculation of deductions. Attention to detail and adherence to the form's sequence can prevent this common oversight.

Another common mistake is not entering the correct maximum amount for the Section 179 election, which can affect the total deduction claimed. This error often stems from not being aware of the annual limits set by the IRS for Section 179 deductions. Taxpayers should verify the current year's maximum deduction limit and ensure that the amount entered on Form 4562 does not exceed this limit. Staying informed about changes in tax laws and limits is essential for accurate tax reporting.

Miscalculating the reduction in limitation for Section 179 property is a mistake that can lead to incorrect deduction amounts. This typically occurs when taxpayers do not properly account for the total cost of Section 179 property placed in service during the tax year exceeding a certain threshold. To avoid this, it is important to accurately calculate the total cost of all Section 179 property and apply the reduction in limitation correctly. Double-checking calculations and seeking professional advice can help ensure accuracy.

Omitting the carryover of disallowed deduction from previous years is a mistake that can result in the loss of valuable deductions. This oversight often happens when taxpayers do not keep accurate records of disallowed Section 179 deductions from prior years. To prevent this, taxpayers should maintain detailed records of all Section 179 deductions, including any amounts that were disallowed and are eligible for carryover. Reviewing past tax returns and consulting with a tax professional can help ensure that all eligible carryover amounts are claimed.

Accurately describing the property and its cost is crucial for the correct calculation of depreciation. Mistakes in this area can lead to incorrect depreciation deductions, affecting the taxpayer's financial statements and tax liabilities. To avoid this, ensure that all property descriptions are detailed and match the actual assets. Additionally, verify the cost basis of each property, including purchase price and any improvements, to ensure accurate depreciation calculations.

Listed property, such as vehicles used for business, has specific reporting requirements. Omitting these amounts can result in underreported deductions or penalties. Taxpayers should carefully review the IRS guidelines on listed property to determine if their assets qualify. It's essential to include all relevant amounts in line 7 to accurately reflect the depreciation of listed property.

The business income limitation affects the amount of depreciation that can be deducted in a given year. Incorrect calculations can lead to either overstating or understating the allowable deduction. Taxpayers should thoroughly understand the rules surrounding business income limitations, including any applicable thresholds or exceptions. Consulting with a tax professional can help ensure that these calculations are performed accurately.

Disallowed depreciation deductions may be carried over to future tax years, but only if properly noted on the current year's return. Failure to document these carryovers can result in lost deductions. Taxpayers should maintain detailed records of any disallowed amounts and ensure they are correctly reported on Form 4562. This attention to detail will safeguard against losing valuable tax benefits.

The special depreciation allowance offers an additional deduction for qualifying property, but incorrect entries can lead to errors in tax filings. It's important to accurately identify property that qualifies for this allowance and to correctly calculate the allowable deduction. Taxpayers should refer to the latest IRS publications for guidance on qualifying property and calculation methods. Ensuring accuracy in this area can maximize tax benefits while maintaining compliance.

A frequent oversight is the failure to provide comprehensive details regarding the depreciation and use of vehicles in Part V of Form 4562. This section requires specific information about the vehicle's cost, the date it was placed in service, and the method of depreciation used. To avoid this mistake, taxpayers should meticulously review their vehicle usage records and ensure all relevant details are accurately reported. Consulting with a tax professional or utilizing tax preparation software can also help in accurately completing this section.

Another common error is the incomplete reporting of amortization details in Part VI. Taxpayers often neglect to include all necessary information about the intangible assets being amortized, such as the description of the asset, the date it was placed in service, and the amortization method. To prevent this, individuals should gather all documentation related to their intangible assets before filling out the form. It's also advisable to double-check the entries against the IRS guidelines to ensure completeness and accuracy.

A significant mistake is the failure to attach Form 4562 to the tax return when required. This form is essential for reporting depreciation and amortization, and omitting it can lead to processing delays or the disallowance of deductions. Taxpayers should verify whether their tax situation necessitates the inclusion of Form 4562 and ensure it is properly attached to their return. Utilizing a checklist during the tax preparation process can help in remembering to include all necessary forms and schedules.

Taxpayers often make the mistake of not consulting the latest IRS instructions for Form 4562, which can lead to errors due to outdated information or missed updates. The IRS periodically updates forms and instructions to reflect changes in tax laws and regulations. To avoid this, individuals should always refer to the most current version of the form and its instructions available on the IRS website. Staying informed about tax law changes and seeking professional advice when necessary can also aid in accurately completing the form.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 4562 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills irs-4562 forms, ensuring each field is accurate.